PayNow is a quick and simple way to transfer money instantly in Singapore. However, the rise of PayNow scams has become a serious concern. Scammers exploit the platform through phishing scams and fake payment requests, luring users into providing sensitive information or making unauthorized transactions.

Our blogpost will help you understand how to identify PayNow scams and protect yourself, ensuring your online payments remain secure and stress-free.

Key Takeaways

- PayNow is a secure way to transfer funds in Singapore using just a mobile number, NRIC, or Virtual Payment Address.

- Common types of PayNow scams include phishing, fake transactions, investment/loan fraud, and refund scams.

- To spot PayNow scams, watch for unexpected requests, suspicious links, and generic sender details.

- If scammed, immediately contact your bank, file a police report, and freeze your linked account..

- Use TurisVPN to secure online transactions and add an extra layer of protection against cyber threats.

What Is PayNow And How Does It Work?

PayNow is an enhanced, instant fund transfer service in Singapore, allowing users to send and receive SGD funds using only a mobile number, NRIC/FIN, or Virtual Payment Address (VPA).

Launched in 2017 for banks and expanded in 2021 to non-bank financial institutions (NFIs), PayNow is available 24/7 and is free for retail customers of participating institutions.

PayNow enables convenient transfers without the need to know the recipient’s bank or account number:

- Log into Your Banking App: Open your online or mobile banking app and select the PayNow option.

- Choose Transfer Method: Select the type of contact you’ll use for the transfer: mobile number, NRIC, or other PayNow-registered details.

- Enter Recipient Details: Type in the recipient’s contact information, such as their mobile number or NRIC, linked to PayNow.

- Add Transfer Amount and Message: Enter the amount you want to transfer and, if needed, include a message for the recipient.

- Confirm and Send: Review all details, then click “Confirm” to complete the transfer.

Types Of PayNow Scams

PayNow scams have been on the rise, impacting thousands of users in Singapore. Here’s the most common types of Paynow Scams: .

Phishing Scams

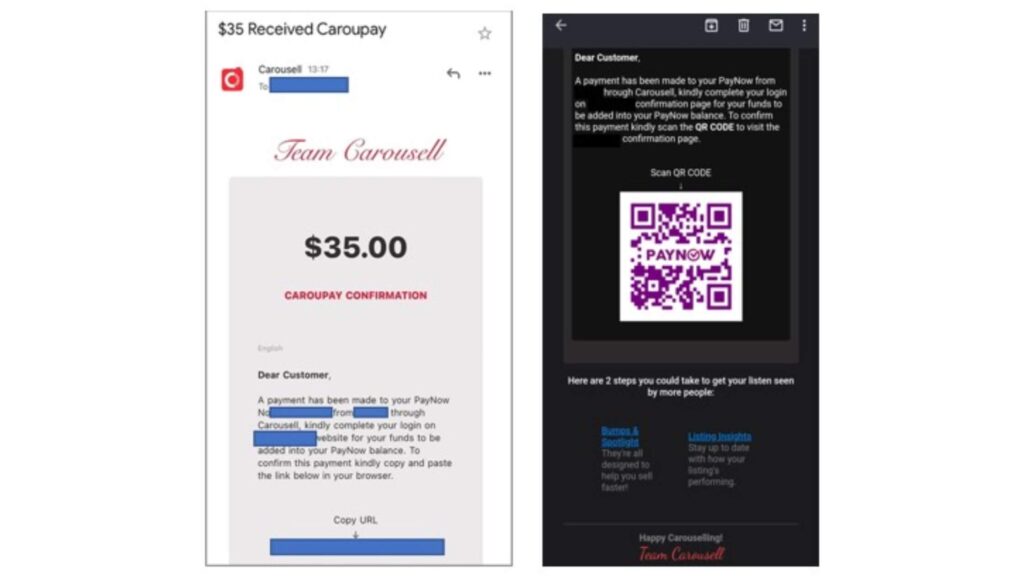

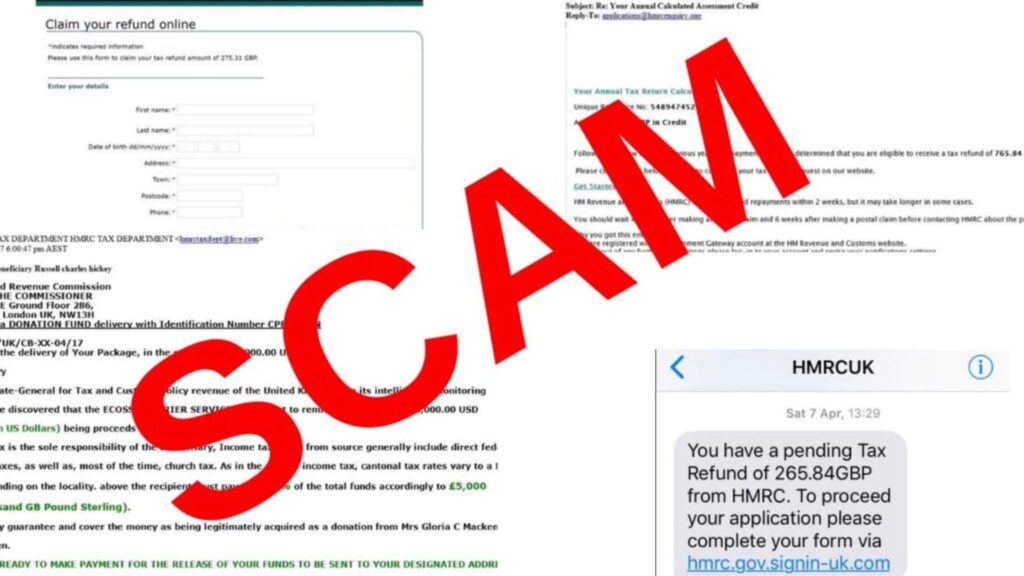

Phishing scams are one of the most frequent types of PayNow scams. Scammers impersonate legitimate banks or institutions, sending messages that appear to be official.

Victims are usually asked to click on a link, which redirects them to a fake website where they are prompted to enter sensitive information, such as login credentials and account details.

In 2021, there were 477 reported cases of PayNow phishing scams, with a substantial increase observed in recent years. The Monetary Authority of Singapore (MAS) has urged users to stay alert and avoid clicking on suspicious links.

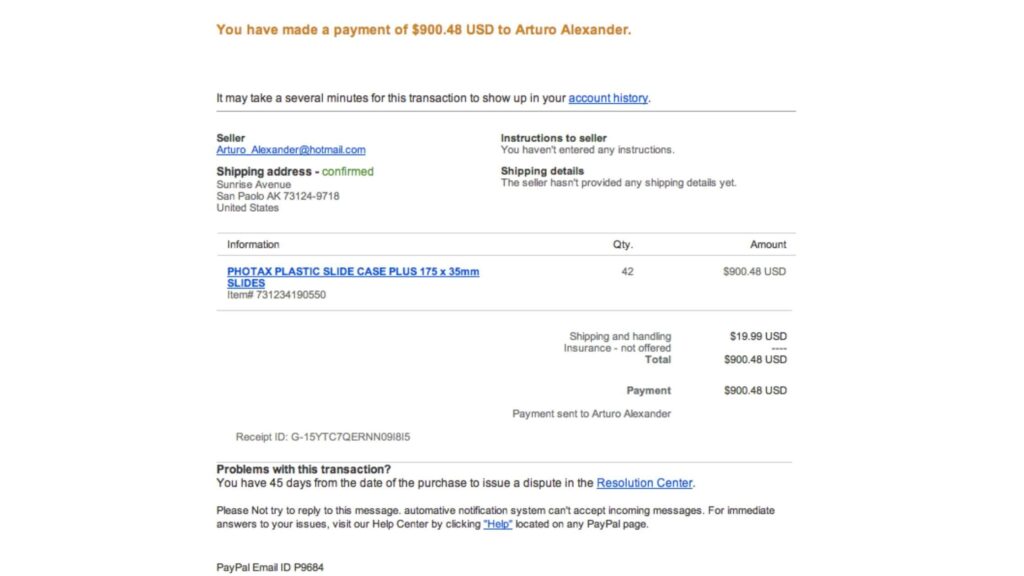

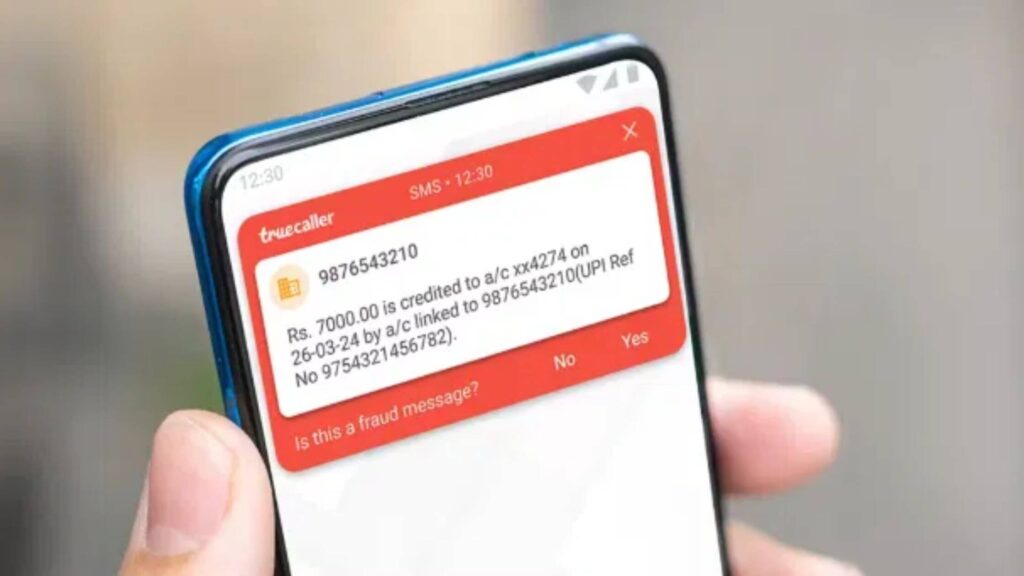

Fake Transaction Scams

In fake transaction scams, scammers impersonate friends, relatives, or acquaintances, claiming they have accidentally sent money via PayNow and request the recipient to refund the payment. However, no actual transaction has taken place, and the scammer’s goal is to trick the user into sending money.

According to Channel News Asia, fake transaction scams are increasingly prevalent, with masked phone numbers and making it harder for users to identify the scam.

Investment and Loan Scams

Investment and loan scams exploit the desire for quick financial gain or low-interest loans. Scammers advertise “too-good-to-be-true” investment opportunities or low-interest loans on social media.

Victims are then asked to transfer a “small” initial amount via PayNow to secure their investment or loan approval. After the payment, scammers often disappear, leaving victims at a loss.

Refund Scams

Refund scams involve scammers contacting PayNow users and pretending to be from a trusted organization, such as a government agency or bank.

They claim that the user is eligible for a refund but needs to provide their PayNow-linked information or make a small payment to release the refund. Once the user makes the payment, they lose the money without receiving any refund.

How to Spot a PayNow Scam?

Recognizing a PayNow scam early can save you from losing money and personal information. Here are some red flags to watch out for in suspicious PayNow messages or transactions:

1. Unexpected Payment Requests

Scammers may claim you owe an urgent or overdue payment, urging you to pay immediately via PayNow. Be especially cautious if the message claims to be from a bank, government agency, or familiar service provider and creates a false sense of urgency.

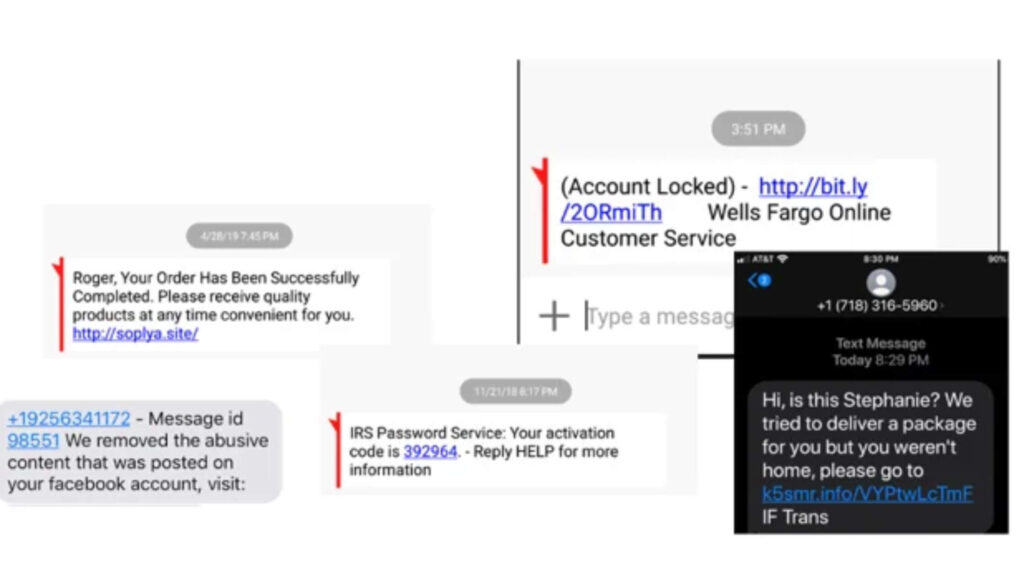

2. Suspicious Links in Messages

Scam messages often contain links that redirect you to phishing sites designed to steal your information. As of 2022, Singapore banks and agencies no longer send clickable links in official SMS messages.

3. Requests for Sensitive Information

Legitimate organizations will never ask you for your passwords, One-Time Passwords (OTPs), or Singpass credentials via text, email, or over the phone. If someone contacts you claiming to be from a bank or government service and asks for these details, it’s a scam.

4. Incorrect or Generic Sender Details

Scammers often use names or numbers that appear official but don’t quite match the genuine source. For example, instead of an official bank name, you might see something generic like “[email protected].”

5. International Country Codes

Messages with unexpected international country codes (+63 for the Philippines, for example) are likely scams. Even if you see a +65 (Singapore) code, remember that numbers can be spoofed, so treat unknown numbers with caution.

6. Claims of “Accidental” Transfers

If someone contacts you claiming they “accidentally” sent money to your account and asks for a refund, verify this carefully. Scammers often use this trick to make you believe you owe them money when, in fact, no transfer was made.

7. Requests to Download Unknown Apps

Scammers sometimes ask victims to install malicious apps disguised as “security software” or “transaction trackers.” Only download apps from official app stores (Google Play or Apple App Store) and be cautious with any direct download links.

8. Spelling and Grammar Mistakes

Scam messages often contain spelling, grammar, or formatting errors. While it might look like a minor detail, official communications from PayNow-related institutions are generally well-edited.

Real-Life Examples of PayNow Scams

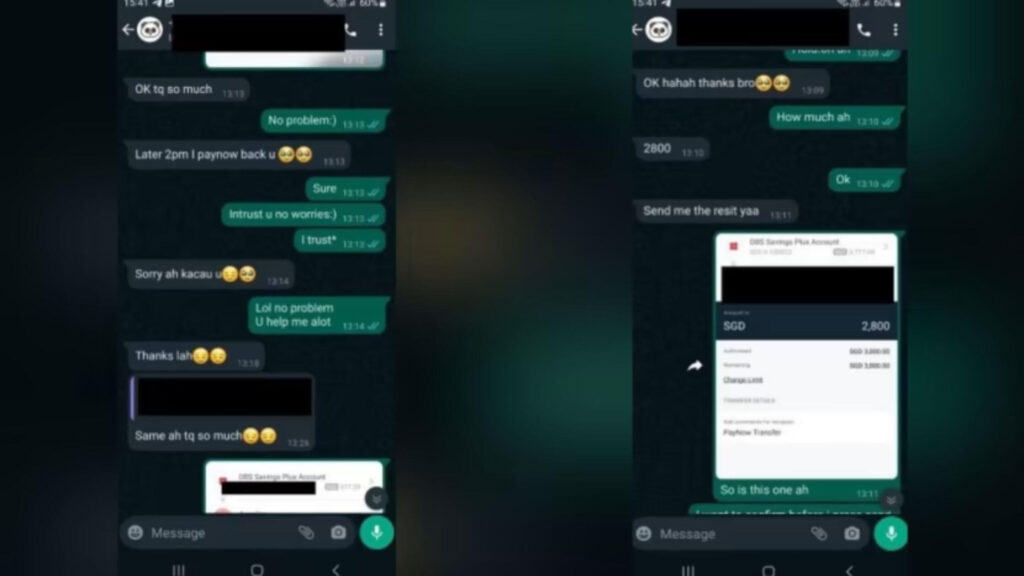

1. Loss of Hard-Earned Money: Fake Friend Scams

In one example, a client at Regent Law lost $80,000 in a “fake friends” scam. This scam typically involves fraudsters posing as friends or acquaintances, even using voice-masking techniques to sound familiar.

Victims are lured into transferring funds, often through multiple transactions, due to the trust built with the scammer. According to Mr. Supramaniam, a lawyer at Regent Law, the losses in these scams usually range from S$30,000 to S$80,000.

2. Widespread Financial Damage

Police statistics reveal that over 6,300 individuals fell victim to “fake friends” scams between January and November last year, with total losses exceeding S$21 million.

3. Challenges in Recovery

Scammers frequently operate through intermediaries, transferring money out of Singapore soon after the transaction. For victims, the delay in detecting the scam – sometimes weeks or months – significantly lowers the chance of retrieval.

What to Do if You Fall for a PayNow Scam?

If you’ve fallen victim to a PayNow scam, follow these steps to take control and improve your chances of recovering funds:

- Contact Your Bank Right Away: Report the unauthorized transaction to your bank immediately. Request to freeze your bank account and online banking to prevent further loss.

- File a Police Report: You can lodge a report online through the Singapore Police Force website or visit a local police station. The Anti-Scam Centre hotline (1800-722-6688) is also available to guide you.The police will ask you for specific details about the scam to help categorize your report accurately.

- Work with the Anti-Scam Centre (ASC): Once your report is filed, an investigation officer will be assigned. The ASC may coordinate with banks to trace and attempt to recover funds.

- Freeze Linked Accounts: Your bank and the police can help freeze accounts involved in the scam to prevent more funds from being transferred.

- Stay Updated on Scam Alerts: Scams evolve constantly. Follow updates from trusted sources to stay informed and recognize new scam tactics quickly.

How to Protect Yourself from PayNow Scams?

Protecting yourself from PayNow scams is essential to secure your finances and personal data. Here’s how to stay safe:

1. Be Cautious of Suspicious Messages:

If you receive unexpected requests for money or sensitive information, double-check the source before taking any action. Legitimate organizations won’t ask for private details this way.

2. Verify Requests from Friends or Family

Scammers may impersonate people you know. Always call or message your contact directly to confirm any requests for money or personal information.

3. Avoid Clicking on Unknown Links

Phishing scams often rely on unverified links to trick users into revealing details. Don’t click on links from untrusted or unexpected messages, especially those claiming to be PayNow.

4. Enable Two-Factor Authentication (2FA)

Activate 2FA on your bank accounts for added security. This way, even if someone has your password, they won’t be able to access your account without a second form of verification.

̀̀̀5. Use Strong, Unique Passwords

Create unique passwords for each of your accounts, using a mix of letters, numbers, and symbols. Avoid reusing passwords across multiple sites to reduce your risk.

6. Stay Updated on the Latest Scam Techniques

Scammers continuously adapt their methods. Keep up with announcements from local security agencies or your bank to stay informed on new scam tactics.

̃7. Use TurisVPN for Secure Connections

Protect your data and browsing activity, especially on public Wi-Fi, by using TurisVPN. A VPN adds an extra layer of security, making it harder for scammers to intercept your online transactions.

Steps to Install TurisVPN:

- Step 1: Visit the TurisVPN website and create an account.

- Step 2: Download the TurisVPN app for your device (available on Windows, macOS, iOS, and Android).

- Step 3: Open the app, log in with your account details, and select a server location.

- Step 4: Click “Connect” to start securing your connection. You’re now ready to browse securely and prevent data tracking.

Bottom Line

PayNow is a convenient tool for quick transfers, but it’s essential to be vigilant against scams. Staying informed, following safe practices, and using protective tools like TurisVPN, you can securely navigate digital transactions and keep your hard-earned money safe. Stay cautious and prioritize your online safety to avoid becoming a target of PayNow scams in 2024 and beyond.

FAQs

Q1. Do victims get their money back from Paynow scams?

No, it’s often difficult to recover funds lost in PayNow scams once the transaction is completed. However, if you act quickly by contacting your bank and filing a police report, there may be a chance to freeze the funds or trace them, especially if you report the incident immediately.

Q2. How to change PayNow nickname?

To change your PayNow nickname, log in to your online banking or mobile banking app. Under the PayNow settings, look for options to manage or edit your registration details. Select “Nickname” and enter your preferred name, then save your changes. Each bank may vary slightly, so if you’re unsure, check with your bank’s support team or online help resources.

Q3. How to check if PayNow is linked to NRIC?

To verify if your PayNow is linked to your NRIC, log in to your bank’s online banking or mobile app. Go to the PayNow section and select “Manage Registration” or “Linked Accounts.” Here, you should see your registered details, including your NRIC if it’s linked. Alternatively, reach out to your bank for confirmation if this option is not available.