The Nigerian Prince scam is one of the most well-known online frauds, tricking people by promising them money from a so-called Nigerian prince.

Even though this scam has been around for a long time, many people still fall for it. In this post, we will explain how the scam works and give you simple tips to avoid it.

Key Takeaways

- The Nigerian Prince scam is a form of advance-fee fraud.

- The 419 fraud name comes from the Nigerian criminal code section related to fraud

- Protect yourself by being skeptical of unsolicited emails, using security tools like TurisVPN, and avoiding sharing personal information online.

What is The Nigerian Prince scam?

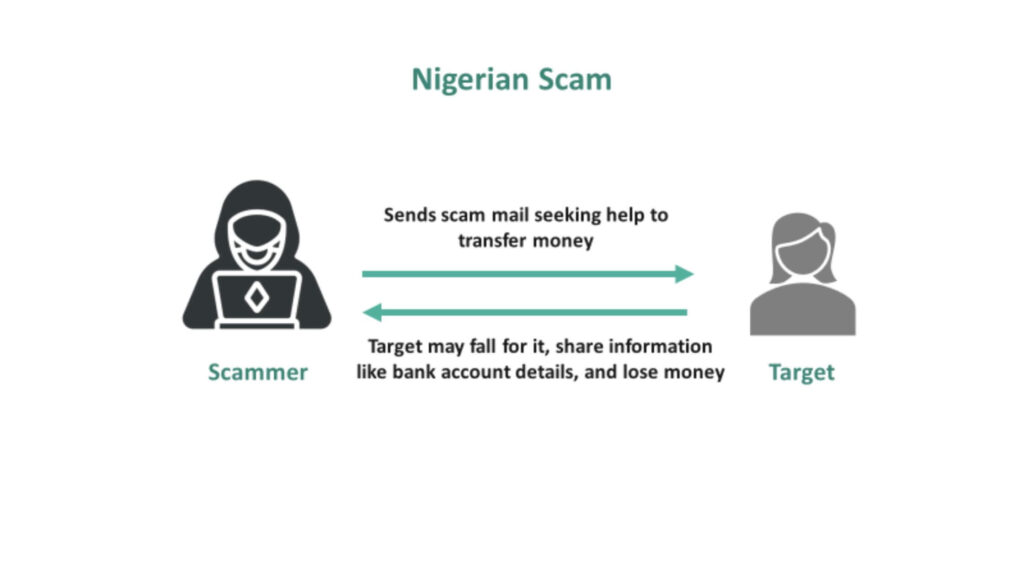

The Nigerian Prince scam is a type of fraud known as an advance-fee scam. Scammers pose as a “prince” or foreign royalty, promising large sums of money in exchange for a small fee upfront.

The goal is to trick people into sending money or sharing bank details. This scam, also called a 419 scam (after Nigeria’s fraud code), is often associated with fake emails from a “prince” needing help to transfer wealth. In reality, no money is sent, and the victim loses their fee or personal information.

Though it’s called the Nigerian Prince scam, it can come from other countries too. Always be cautious when you receive unsolicited offers of wealth.

How Does Nigerian Prince Scam Work?

The Nigerian Prince scam tricks people into believing they will receive a large sum of money in exchange for a small favor. Here’s how it works in simple steps:

- The story: The scammer pretends to be a rich prince or official who needs help moving their fortune. They claim to be stuck because of political problems or legal issues.

- Emotional appeal: They tug at your emotions, saying they need your help. They promise to share their wealth with you once their money is transferred.

- The request: The scammer asks you to send them a small amount of money upfront to cover fees or provide personal details like your bank info to “help” transfer the money.

The disappearance: After you send the money or share your information, the scammer disappears. You’re left with no reward, and sometimes worse, your personal details are stolen.

This scam plays on people’s hopes for easy money but leads to financial loss instead. Be aware and avoid sharing your money or personal information with strangers online.

The Origins of the Nigerian Prince Scam: 419 Fraud

The Nigerian Prince scam has its roots in an old scheme called the Spanish prisoner swindle, which dates back to the early 1900s. In both scams, the victim is told that a rich foreign nobleman is stuck in trouble and needs help.

In return for sending some money to help him, the victim is promised a share of a hidden treasure. Of course, there is no treasure, and once the money is sent, the scammer disappears.

Today, the Nigerian Prince scam works in a similar way, using emails to reach potential victims. The scammer pretends to be a wealthy Nigerian royal or official, offering a huge fortune if you can help them with a small payment.

Though the story has changed over time, the goal remains the same—to trick people into giving away money or personal information.

The Aftermath of The Nigerian Prince scam

The Nigerian Prince scam has caused significant financial harm over the years. It’s estimated that these scams have resulted in over $2.5 billion in losses worldwide in the past decade.

In the U.S. alone, Americans lost $703,000 to such scams in just one year, according to data from ADT Security Services and the Better Business Bureau’s Scam Tracker.

On average, victims of Nigerian letter-style scams lose about $2,133 each. Although this type of fraud can be devastating, other scams like investment fraud and romance scams tend to be even more costly for victims.

Investment fraud victims, including those affected by Ponzi schemes, have lost an average of $8,648, while romance scam victims have lost around $6,003.

The Nigerian Prince scam typically targets vulnerable individuals, often the elderly, preying on emotions and trust. The impact of these scams isn’t just financial—it can also cause emotional distress, leading victims to feel ashamed or embarrassed, which sometimes prevents them from reporting the fraud.

As long as these scams continue to succeed, scammers will keep using them to exploit unsuspecting victims.

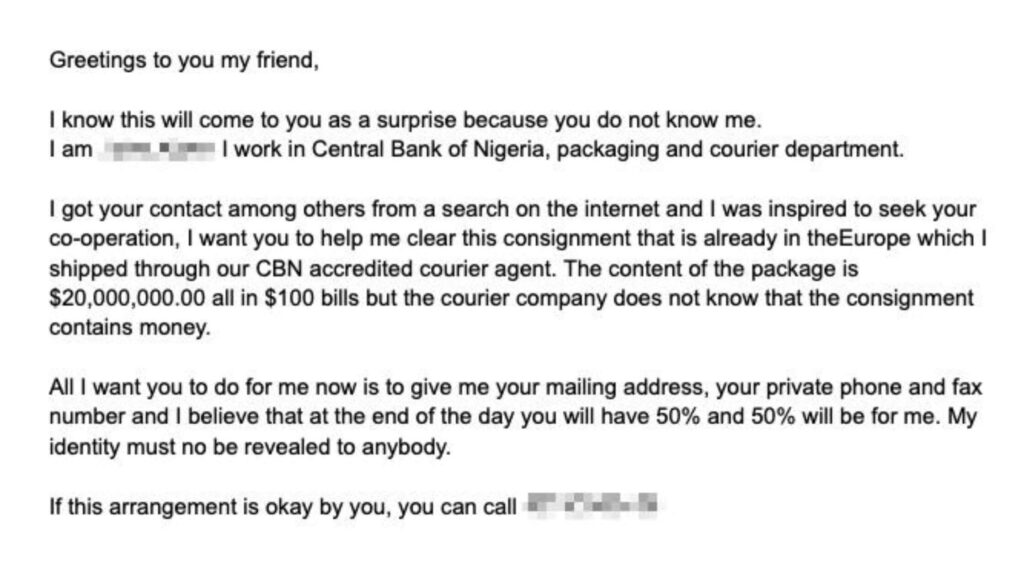

Email Examples of Nigerian Prince Scam

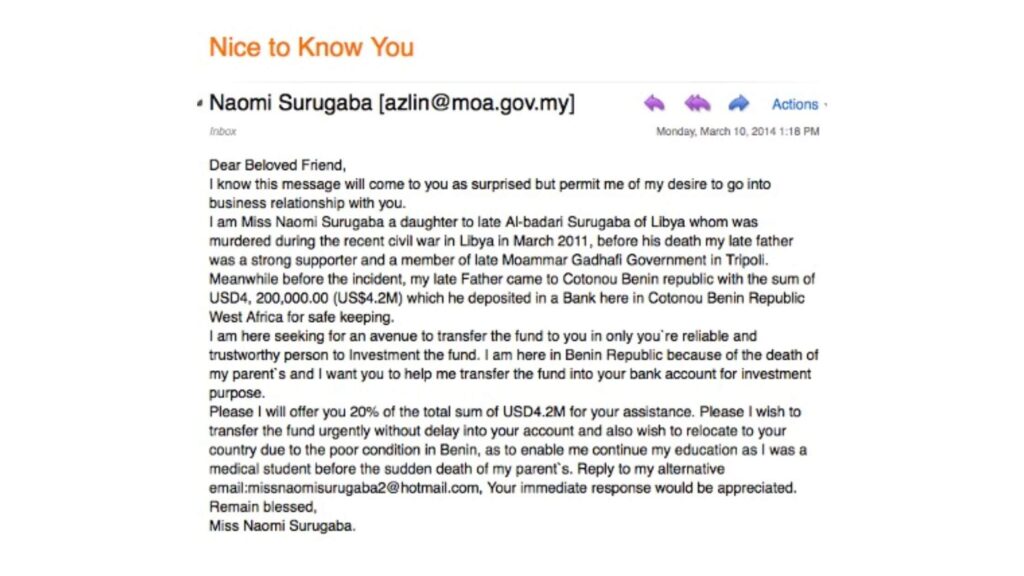

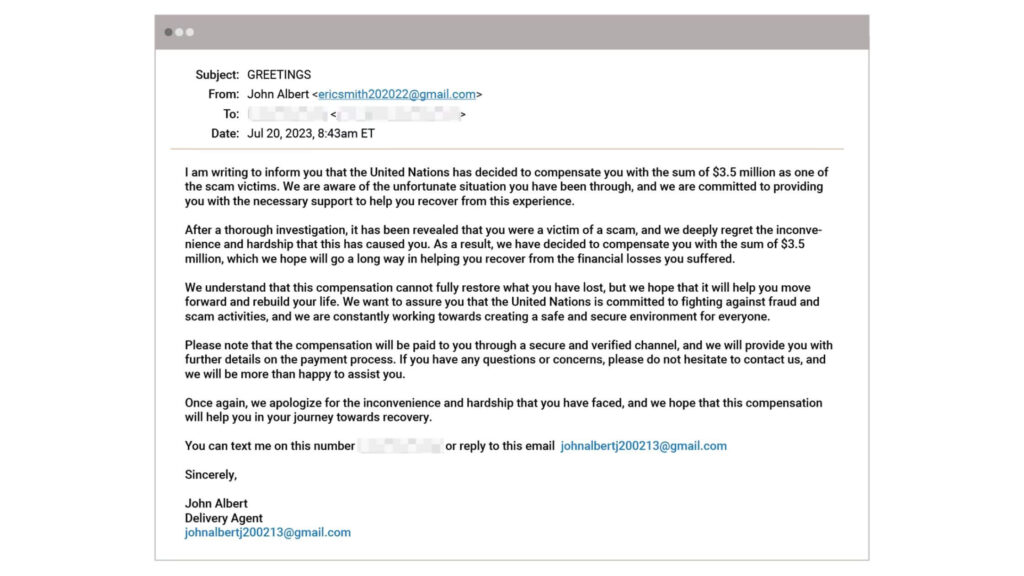

The Nigerian Prince scam often follows a similar pattern, making it relatively easy to spot if you know what to look for. Scammers typically present themselves as a wealthy nobleman, government official, or someone in distress, claiming they need your help to transfer large sums of money.

In exchange, you’re promised a cut of the fortune. However, to facilitate the transfer, you’re asked to pay a small fee upfront or provide sensitive personal details, such as your bank information.

Common Signals of Nigerian Prince Scams:

- Promises of Large Sums of Money: Emails offering large rewards for little effort are a major red flag.

- Urgency: Scammers will emphasize the need for urgent action to pressure you into making quick decisions.

- Requests for Personal Information: Any request for sensitive information like bank details, social security numbers, or passport information is a sure sign of fraud.

- Unrealistic Backstories: The tales often sound too good to be true, with elaborate stories of nobility or riches tied up in foreign banks.

- Unprofessional Language: These emails often contain grammar mistakes, poor formatting, and odd phrasing.

Example 1:

Example 2:

Example 3:

While the original “Nigerian Prince” scam was focused on royalty from Africa, scammers have evolved their techniques. Modern variations may come from other regions, and the appeal for assistance might involve more believable scenarios, such as foreign businesses, humanitarian efforts, or investments.

The Ways Scammers Get My Contact Information

Scammers can obtain your contact information through a variety of ways. Here are some of the most common methods they use:

- Phishing scams: Fake emails or texts trick you into providing your contact info, which scammers then use for future scams.

- The Dark Web: Stolen data from breaches is often sold on the dark web, giving scammers access to your contact information.

- Social media profiles: Many social platforms require your phone number or email during registration, and scammers can scrape these details if they are made public.

- Target lists: Scammers buy or exchange lists of people who have fallen victim to scams before, marking them as “easy targets.”

- Shoulder surfing: This low-tech way involves looking over your shoulder as you enter personal information, like your phone number or email.

- Autodialers: Automated systems that dial random numbers until they find an active phone line, which is then used for scams.

- Data broker lists: Information can be sold by third-party data brokers, which gather details from online forms, surveys, and other sources.

- Stolen mail: Physical theft of your mail can provide scammers with sensitive details.

What To Do If You Received The 419 Scam?

If you’ve received a 419 scam message, here’s what to do:

- Don’t respond: Avoid replying to the email or message in any way. Engaging with the scammer may lead to further attempts to defraud you.

- Report it: Forward the scam email to your local law enforcement agencies, such as the U.S. Secret Service, the Federal Trade Commission (FTC), or the FBI. Reporting scams helps authorities investigate and track down scammers.

- Register a complaint: You can file a complaint with the FTC through their Complaint Assistant.

- Guard your details: Never give out personal information such as bank account details, Social Security numbers, or passport information to unknown senders.

Warn others: If you know someone corresponding with a scammer, encourage them to contact the authorities immediately to avoid falling victim.

How To Protect Yourself Against Email Scams?

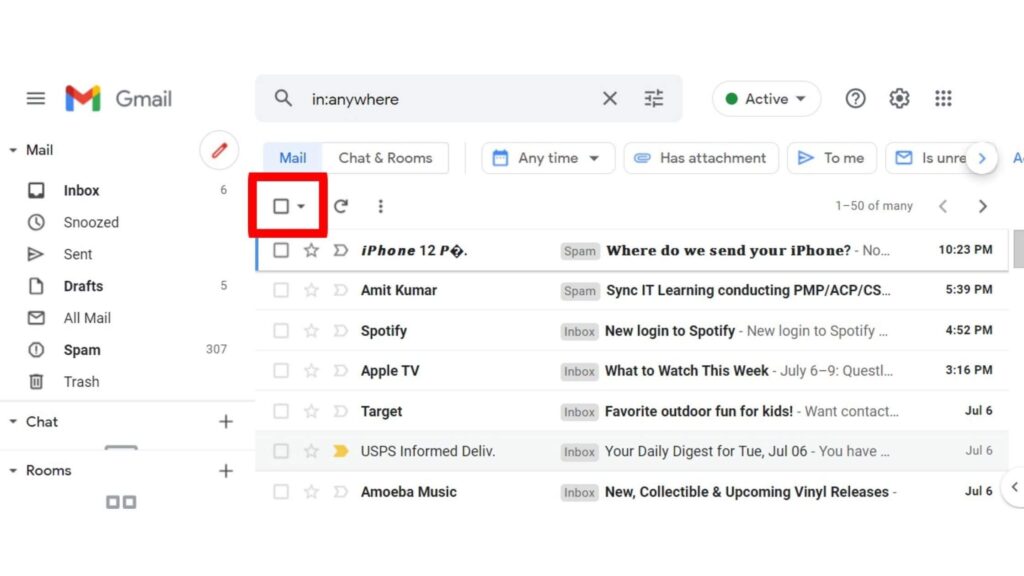

Tip #1. Delete random email

If you receive unsolicited emails from unknown sources, delete them without opening. Scammers often use these emails to bait victims into responding. Even clicking on links or downloading attachments can expose you to malware. Stick to trusted contacts and companies that you recognize.

Tip #2. Don’t give personal information

Never share sensitive personal details such as your bank account, social security number, or even your birthday through email. Scammers use this data to steal your identity or drain your accounts. Always verify the identity of the person or company requesting the information by contacting them directly through official means.

Tip #3. Use Multiple Email Accounts

It’s wise to maintain several email accounts to avoid spam. For example, use one for personal matters, another for work, and a third for online registrations. This way, if one account gets compromised, it won’t affect your entire online presence.

Tip #4: Be Skeptical of “Too Good to Be True” Offers

If someone promises you a large sum of money, free prizes, or opportunities that sound too good to be true, they probably are scams. Scammers rely on urgency and greed to trick people into sharing personal or financial details.

Tip #5: Use TurisVPN for Enhanced Security

TurisVPN can help protect your email activity from scammers by encrypting your connection and masking your IP address. Here’s how to use it:

- Step 1: Download and install TurisVPN from their official website.

- Step 2: Sign up and log in.

- Step 3: Connect to a server to protect your browsing data.

- Step 4: Now browse or check emails with a secure and private connection, reducing the risk of phishing attacks.

Closing Thoughts

The Nigerian Prince scam is an online fraud that has evolved over the years, tricking victims into giving away their money or personal information. Using strong security tools like TurisVPN can also help protect your online activity, making it harder for scammers to target you. Stay informed and always be cautious with unsolicited emails and offers that seem too good to be true.

FAQs

Q1. What is the 419 email from the Nigerian prince?

The 419 email refers to a type of scam where a “Nigerian prince” promises a large sum of money in exchange for a small upfront payment or personal information.

The name “419” comes from the section of the Nigerian penal code that deals with fraud. The scammer pretends to be a wealthy nobleman in need of assistance to transfer money, and the victim is tricked into providing funds or sensitive information, which is then exploited.

Q2. How to catch a Nigerian scammer?

To catch a Nigerian scammer, it’s crucial to report any suspicious emails or messages to authorities like the Internet Crime Complaint Center (IC3) or local law enforcement. Avoid engaging with the scammer.

If you suspect fraud, save all communication as evidence, avoid providing personal details, and always verify the legitimacy of any offers. Additionally, using services like TurisVPN can help protect your identity and make it harder for scammers to target you online.